1.) Distinguish between the benefits-received and the ability-to-pay principles of taxation. Which philosophy is more evident in the present US tax structure? Justify your answer.

To which principle of taxation do you subscribe? Why?

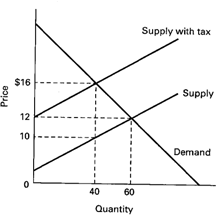

2.) Examine the graph below, and then answer the following two questions.

(a) What is the tax burden to the seller?

(b) What is the tax burden to the buyer?

3.) In what respect is the economic decision to move across international borders an investment decision?

4.) What are the "twin" problems of the health care industry as viewed by society? How are they related?