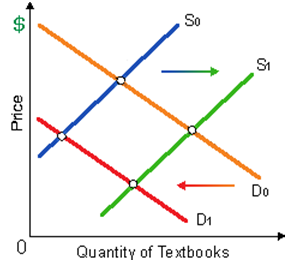

It shifts within the demand for new textbooks from D0 to D1 may be a result of: (1) increased enrollments of students. (2) consumers' expectations of a future increase within the price of textbooks. (3) increased literacy rates. (4) increasingly efficient E-bay auctions of used books which drove down prices for used texts. (5) an increase within the cost of producing new textbooks.

I need a good answer on the topic of Economic problems. Please give me your suggestion for the same by using above options.