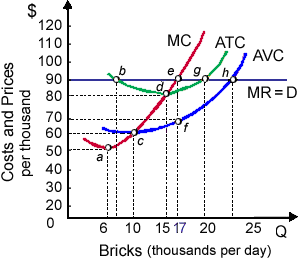

This profit-maximizing, as in demonstrated graph, of brickyard’s total variable costs are about: (i) $200 per day. (ii) $600 per day. (iii) $750 per day. (iv) $900 per day. (v) $1200 per day.

How can I solve my Economics problem? Please suggest me the correct answer.