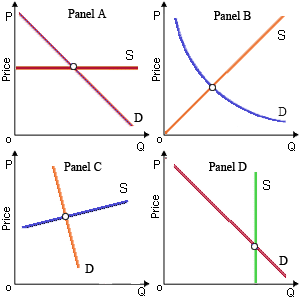

The burden of an excise (i.e., per unit) tax would be divide roughly fifty by fifty on consumers and suppliers of the taxed good within: (w) Panel A. (x) Panel B. (y) Panel C. (z) Panel D.

Hello guys I want your advice. Please recommend some views for above Economics problems.