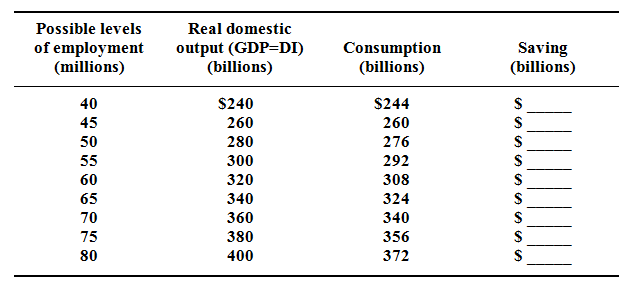

Supposing the level of investment is $16 billion and independent of the level of net output, complete the following table and find out the equilibrium levels of output and employment in this private closed economy. Determine the sizes of the MPC and MPS?