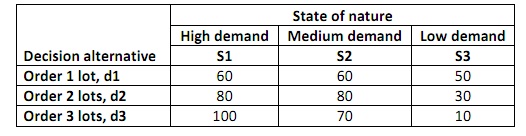

A department store faces a decision for a seasonal product for which demand can be high, medium or low. The purchaser can order 1, 2 or 3 lots of this product before the season begins but cannot reorder later. Profit projections (in thousands of euro) are shown below:

1. If the probabilities are 0.3 for high, 0.3 for medium and 0.4 for low, what is the recommended order quantity? Calculate the expected return based on these values.

2. Simulate twenty seasons and identify the recommended order quantity from this simulation ?

3. Calculate the average return based on the simulated demand and compare your result with the expected return ?