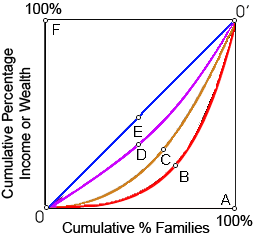

If this illustrated figure given Lorenz curves for distribution of income after taxes and transfers, the probably short run effects of 10 percent increases within both income tax rates and government transfer payments would be: (1) country's distribution of income would be unaffected. (2) country's after-tax and transfer Lorenz curve could shift to line 0B0'. (3) cuts could move the Lorenz curve towards the line 0E0'of perfect equality. (4) country's after-tax and transfer Lorenz curve could move to line 0D0'. (5) Lorenz curve would shift away by line OF0', the line of perfect inequity.

Hey friends please give your opinion for the problem of Economics that is given above.