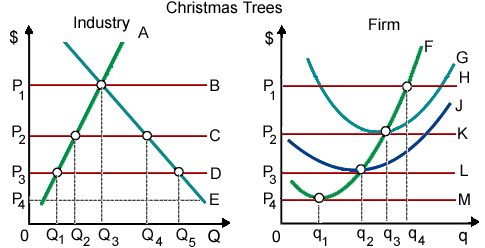

When the price for Christmas trees is initially P1, in that case in the long run: (w) firms will neither enter nor exit this industry. (x) entry of firms will shift curve supply curve A to the right. (y) exit of firms will shift supply curve A to the left. (z) entry of new firms will shift that firm’s curve F to the right.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?