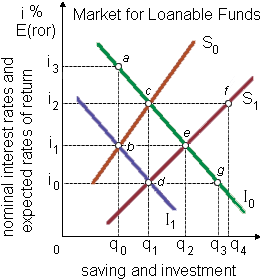

Assume that this market is initially within equilibrium along with a supply of funds consequent to S0 and a demand for loanable funds consequent to I1. When the U.S. Department of the Treasury began selling more bonds to fund a growing federal budget deficit, in this would be probably to cause: (1) a shift in the demand for loanable funds through I1 to I0. (2) the rate of return schedule reflected in I0 to shift to the left. (3) a movement down the saving schedule from point b to point d. (4) a movement in this market by point b to point e. (5) households to reverse their saving plans.

Can someone explain/help me with best solution about problem of Economics...