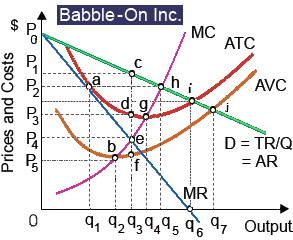

Assume that Babble-On’s patents for speech-translation software covering 314 languages lapsed, as well as entry of new competitors within this market eroded the demand for Babble-On software, but the firm retains several market powers since competitors’ products are not perfect substitutes. Assume that the new demand curve facing Babble-On is precisely its previous marginal revenue curve. Therefore babble-On would be expected to: (w) produce q2 output since minimum average variable cost corresponds to point b. (x) set its price equal to P2 and produce output q1. (y) exit the industry because its maximum possible accounting profit is zero. (z) operate at a level of output which exceeds the efficient level for society as a entire.

Hello guys I want your advice. Please recommend some views for above Economics problems.