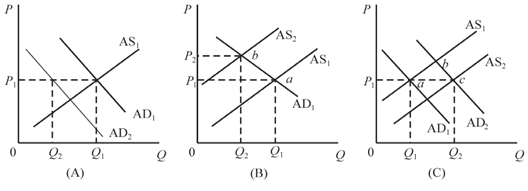

Refer to the following diagrams, in which AD1 and AS1 are the "before" curves and AD2 and AS2 are the "after" curves. Other things equal, a decrease in resource prices is depicted by:1) panel (A) only. 2) panel (B) only. 3) panel (C) only. 4) panels (B) and (C)

Help me to go through this problem.