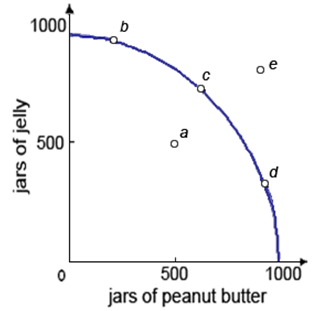

I have a problem in economics on reading the Production Possibilities Frontiers graph. Please help me in determining the right answer from the following question. The graph below depicts the mythical country of the Sandwichia’s:

(1) Production possibilities frontier. (2) Trade-off among reward and risk. (3) Circular flow of the income. (4) Total demand curve. (5) Total cost curve.

Please choose the right answer from above...I want your suggestion for the same.