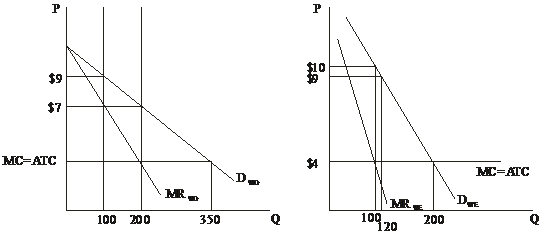

Refer to the following figure . Assume the graphs represent the demand for use of a local golf course for which there is no significant competition (it has a local monopoly); P indicates the price of a round of golf; Q is the quantity of rounds "sold" each day. If the left graph depictes the demand during weekdays, and the right graph the weekend demand, this profit-maximizing golf course will earn how much economic profit over the course of a full seven-day week? A) $4200 B) $3700 C) $3400 D) $2700