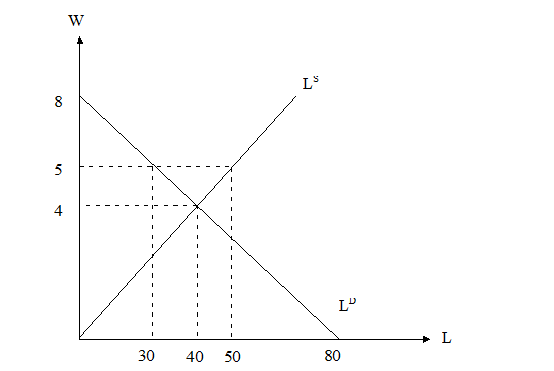

In the year of 1996, the U.S. Congress raised the minimum wage from $4.25 per hour to $5.15 per hour. Some of the people suggested that a government subsidy could help employers finance the higher wage. Assume the supply of low-skilled labour is specified by

LS= 10w

where LS is the quantity of low-skilled labour (in millions of persons employed each year) and w is the wage rate (in dollars per hour). The demand for labour is specified by

LD =80-10w

What will be the level of free market wage rate & employment? Assume the government sets a minimum wage of $5 per hour. How many people would be employed then?

In a free-market equilibrium, LS = LD. Solving out yields w = $4 and LS = LD = 40. If the minimum wage is $5, then LS = 50 and LD = 30. The number of people employed will be specified by the labour demand, thus employers will hire 30 million workers.