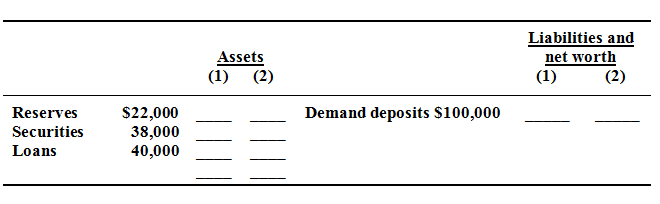

Assume the Yukon Bank has the given simplified balance sheet. The reserve ratio is 6.25 %.

Determine the maximum amount of new loans which this bank can make? Illustrates in column 1 how the bank's balance sheet will seem after the bank has loaned this added amount.