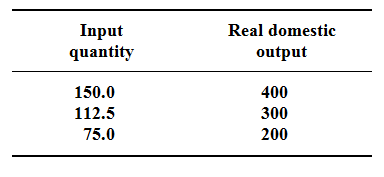

Assume that any hypothetical economy had the specified relationship among its real domestic output & the input quantities necessary for producing that level of output:

Assume that the rise in input price had not taken place but instead that productivity had risen by 100 percent. Define new per unit cost of production? What influence would this change in per unit production cost put on the aggregate supply curve? Determine effect of this shift in aggregate supply on the price level and the level of real output?