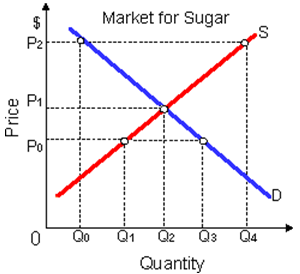

These supply and demand curves for sugar propose that the: (1) demand price exceeds the supply price at quantity Q2. (2) technology should advance to allow output to develop to Q4. (3) quantity demanded equals quantity supplied at P1. (4) market experiences a shortage at P2. (5) government has set an effectual price floor at P02.

How can I solve my economics problem? Please suggest me the correct answer.