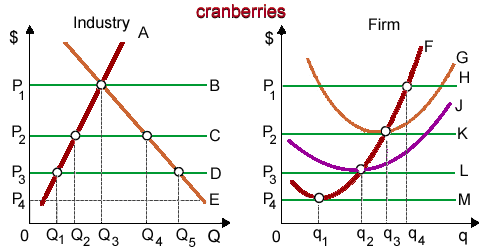

For the purely-competitive cranberry market, as in below figure there Curve H is: (i) industry’s long-run supply curve. (ii) firm’s demand curve in the short run. (iii) industry’s marginal cost curve. (iv) firm’s long run marginal cost curve.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?