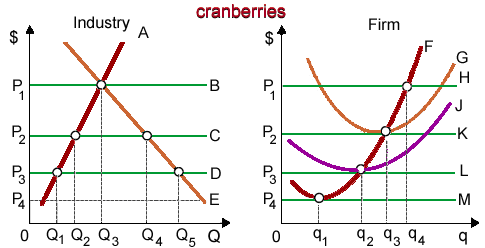

When this firm is typical into this purely-competitive of constant-cost industry, as in demonstrated figure in long-run equilibrium for cranberries will be attained at a market price of: (i) P1. (ii) P2. (iii) P3. (iv) P4. (v) Not computable from these figures.

Hey friends please give your opinion for the problem of Economics that is given above.