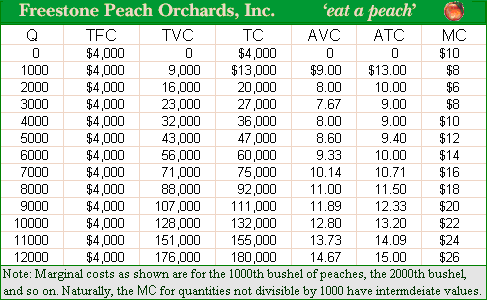

When the wholesale price per bushel of peaches is $9, Cling Peach Orchards would be probably to break even when its peach orchard produced approximately: (i) 2000 bushels of peaches. (ii) 2500 bushels of peaches. (iii) 3000 bushels of peaches. (iv) 3500 bushels of peaches. (v) 4000 bushels of peaches.

Please choose the right answer from above...I want your suggestion for the same.