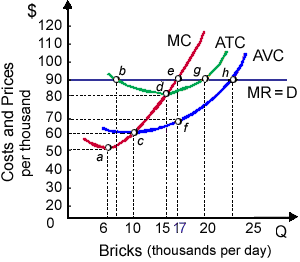

This profit-maximizing brickyard of below illustrated figure on the average is, about: (i) making an economic profit of $8 per thousand bricks. (ii) incurring variable costs of $90 per thousand bricks. (iii) suffering an accounting loss of $2 per thousand bricks. (iv) operating at a profit of $9 per brick.

Hey friends please give your opinion for the problem of Economics that is given above.