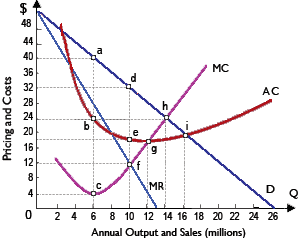

Prohibition Corporation would exactly break-even on its St. Valentine’s Day software when, in place of correctly identifying its profit maximizing strategy, this: (1) operated at point i, charging just $20 per copy and producing 16 million copies. (2) priced the software at $48 and sold just 1.8 million copies. (3) charged $32 per copy and sold 10 million copies. (4) produced 13 million copies as well as sold them for $27 apiece.

Hey friends please give your opinion for the problem of Economics that is given above.