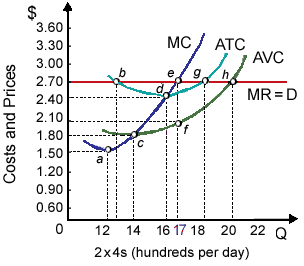

On the average, that profit-maximizing lumber mill as in demonstrated graph is: (w) making an economic profit of regarding $0.20 (20¢) per 2×4. (x) incurring variable costs of $0.90 (90¢) per 2×4. (y) suffering an accounting loss of $0.90 (90¢) per 2×4. (z) operating at an economic profit of $1 per 2×4.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?