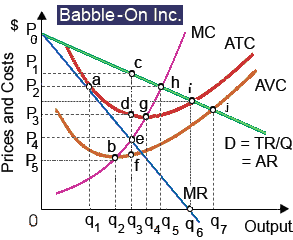

Babble-On maintains world-wide patents for software which translates any of three-hundred-thirteen spoken languages within text, along with automatic audio and text translations within any of the other three-hundred-thirteen languages. Babble-On's profit-maximizing conclusion would be to operate at output: (1) q1 and price P2. (2) q2 and price P5. (3) q3 and price P1. (4) q4 and price P3. (5) q5 and price P2.

Hello guys I want your advice. Please recommend some views for above Economics problems.