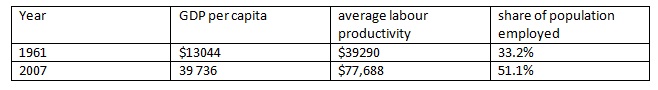

Between 1961 and 2007, the rising share of the Canadian population in paid employment contributed to rising GDP per person. But suppose that the share of the Canadian population in paid employment had remained constant between 1961 and 2007. What would Canadian GDP per person have been in 2007? Make use of the relevant data from the following table: