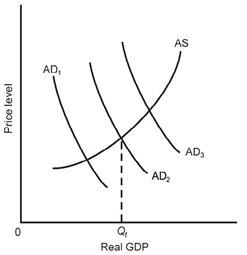

Refer to the below diagram, in which Qf is the full-employment output. If aggregate demand curve AD1 describes the current situation, appropriate fiscal policy would be to: A) increase taxes and reduce government spending to shift the aggregate demand curve rightward to AD2. B) reduce taxes on businesses to shift the aggregate supply curve leftward. C) reduce taxes and increase government spending to shift the aggregate demand curve from AD1 to AD2. D) do nothing since the economy appears to be achieving full-employment real GDP.

Help me to solve this problem