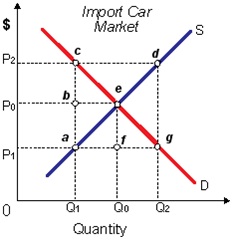

Imports and American cars are much close however not perfect replacements. When the U.S. govt. tried to enhance American car sales by setting a price ceiling of P1 on imported cars: (i) The quantity of cars imported will drop/fall from Q0 to Q1. (ii) American car prices would increase to P2. (iii) Foreign car exporters would ship much luxury cars to the United States. (iv) American made car sales would increase by Q2 to Q0.

Can someone help me in getting through this problem.