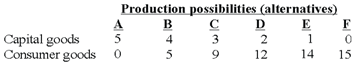

Refer to the given table. If the economy is producing at production alternative C, the opportunity cost of the tenth unit of consumer goods will be:

1) 4 units of capital goods. 2) 2 units of capital goods. 3) 3 units of capital goods. 4) 1/3 of a unit of capital goods.