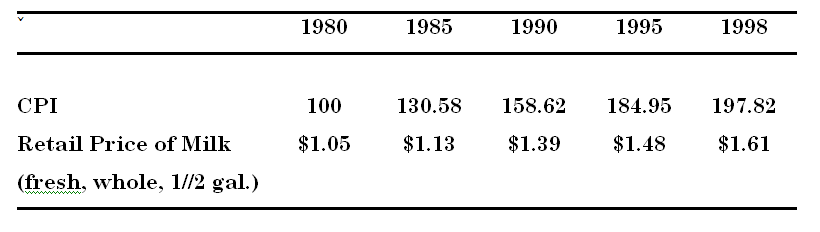

Table indicate the average retail price of milk and the Consumer Price Index in the year 1980 -1998.

Alter the CPI into 1990 = 100 and find out the real price of milk in the year of 1990 dollars.

To alter the CPI into 1990=100, divide the CPI for each year by the CPI for 1990. Employ the formula from part a & the new CPI numbers below to determine the real price of milk.

New CPI 1980 63 Real price of milk 1980 $1.67

1985 82 1985 $1.38

1990 100 1990 $1.39

1995 117 1995 $1.26

1998 125 1998 $1.29