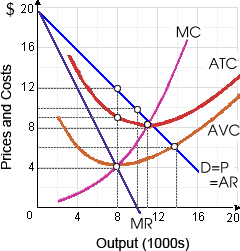

The price elasticity of demand equals one when this firm produces where total revenue is: (i) $72,000 per period. (ii) $80,000 per period. (iii) $96,000 per period. (iv) $100,000 per period. (v) $144,000 per period.

Hey friends please give your opinion for the problem of Economics that is given above.