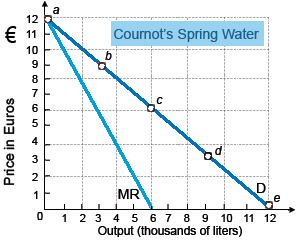

Monsieur Cournot has a monopoly on an artesian well from that flows tasty spring water reputed to have medicinal properties. To ignore incurring variable costs, he is adamants that customers bring their own pails and also fill them individually. Unfortunately, Cournot can’t price discriminate since his customers all deal along with each other regularly. Cournot’s good strategy for maximizing profit is to: (i) market the amount of water where demand is perfectly price elastic. (ii) ensure that every person willing to pay at all buys some of his water. (iii) charge as much per pail as the most desperate buyer would be willing to pay. (iv) sell 6,000 liters per period at a price of six Euros [€6 ]per liter. (v) market the amount of water where demand is perfectly price inelastic.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?