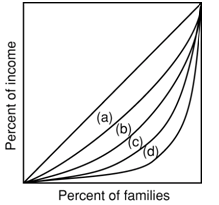

Refer to the following diagram. If line b represents the pretax and transfer distribution of income in the United States, we would expect the post-tax and transfer distribution to be: A) line a. B) line b, because taxes and transfers have no effect on income distribution. C) line c. D) line d.

Help me to get through this problem.