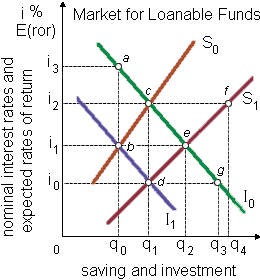

This capital market is within a closed private economy. Primary plans of savers and investors are demonstrated as curves S0 and I0. There Market equilibrium will exist at: (1) point a. (2) point b. (3) point c. (4) point d. (5) point e.

Hey friends please give your opinion for the problem of Economics that is given above.