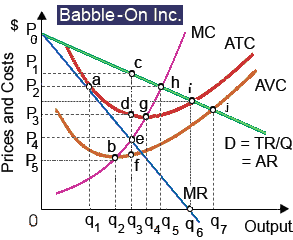

Babble-On holds world-extensive patents for software which translates any of 314 spoken languages within text, along with automatic audio and text translations within any of the other three-hundred-thirteen languages. This figure illustrates that Babble-On as: (1) is a quantity-adjusting price gouger firm. (2) will be precisely compensated for its opportunity costs. (3) faces a perfectly price inelastic market demand curve. (4) has market power as a price maker. (5) has profit equal to area dcP1P3 only when it price discriminates perfectly.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?