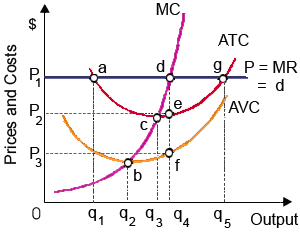

The profit maximizing competitive firm in illustrated graph will: (i) produce output level q5. (ii) minimize total costs by producing output level q3. (iii) experience fixed costs equal to 0P3fq4. (iv) produce output level q4. (v) inevitably experience economic losses.

How can I solve my Economics problem? Please suggest me the correct answer.