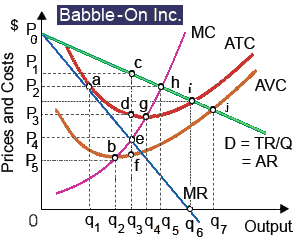

Babble-On maintains world-wide patents for software which translates any of 314 spoken languages into text, along with automatic audio and text translations into some of the other three-hundred-thirteen languages. Facing Babble-On the demand curve has unitary price elasticity at: (1) output q1. (2) output q3. (3) output q4. (4) output q6. (5) output q7.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?