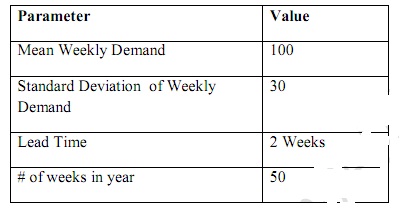

Consider the following data pertaining to a distribution center.

Ordering cost: $50 /order

Holding cost: $4 /unit /week.

Cycle service level: 97%

Summary:

The question is related to cost accounting in finance. It deals with measures such as Order Quantity, Cycle Inventory, Safety Inventory, Reorder Level, Annual Inventory Holding, Annual Ordering Cost, etc. All these measures are calculated according to given cost and time.