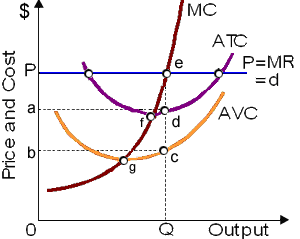

When this purely-competitive firm makes output level Q, this is operating within the: (i) technological long run. (ii) long run. (iii) short run. (iv) shut down period. (v) boom period of the business cycle.

Hello guys I want your advice. Please recommend some views for above Economics problems.