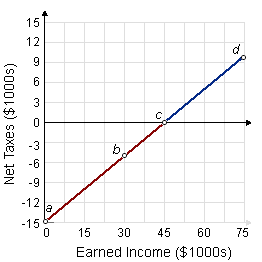

Under the negative income tax system demonstrated in this given figure, a family of four along with earned income of $75,000 per year would have a net as [after-tax] income of: (i) $15,000 per year. (ii) $30,000 per year. (iii) $45,000 per year. (iv) $60,000 per year. (v) $75,000 per year.

How can I solve my Economics problem? Please suggest me the correct answer.