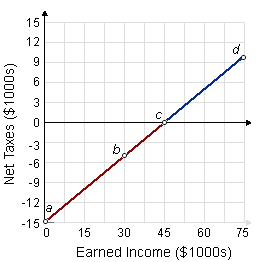

Under the negative income tax system demonstrated in this figure, a family of four along with no earned income would have a net after-tax income of: (1) $15,000 per year. (2) $10,000 per year. (3) $5,000 per year. (4) $2,500 per year. (5) $0 per year.

I need a good answer on the topic of Economics problems. Please give me your suggestion for the same by using above options.