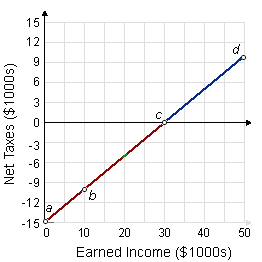

Under negative income tax system demonstrated in this figure, where a family of four all along with earned income of price of $15,000 per year would have a net income after-tax, as of: (1) $30,000 per year. (2) $27,500 per year. (3) $25,000 per year. (4) $22,500 per year. (5) $20,000 per year.

Can someone explain/help me with best solution about problem of Economics...