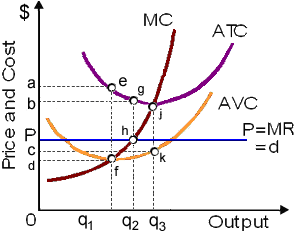

Hello guys I want your advice. Please recommend some views for below illustrated figure of Economics problem that for this profit-maximizing pure competitor, area Pbgh signifies: (1) fixed cost (TFC). (2) average fixed cost (AFC). (3) losses, but the minimum possible economic losses. (4) maximum positive economic profits. (5) rate of return on investment.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?