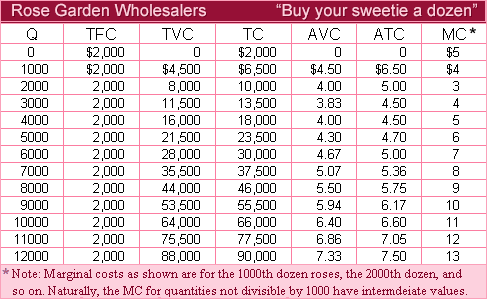

The wholesale price per dozen roses below that such purely competitive rose farm would minimize losses through closing their operation is: (1) $3.00 per dozen roses. (2) $3.83 per dozen roses. (3) $4.00 per dozen roses. (4) $4.30 per dozen roses. (5) $5.00 per dozen roses.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?