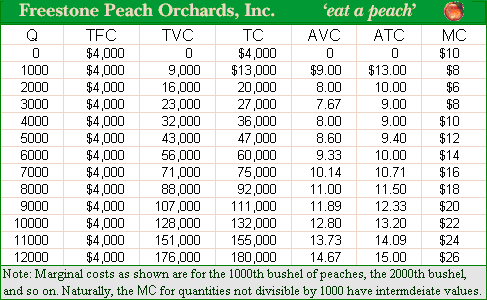

The wholesale price per bushel of peaches below that it purely competitive peach orchard would minimize losses via shutting down its operations is: (1) $4.00 per bushel of peaches. (2) $7.67 per bushel of peaches. (3) $8.00 per bushel of peaches. (4) $9.33 per bushel of peaches. (5) $15.00 per bushel of peaches.

I need a good answer on the topic of Economics problems. Please give me your suggestion for the same by using above options.