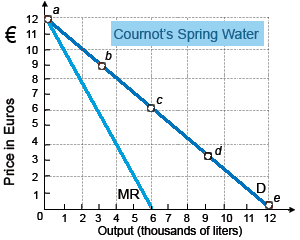

Monsieur Cournot has a monopoly on an artesian well from that flows tasty spring water along with medicinal properties. To ignore variable costs, he is adamants that customers bring their own pails and fill them individually. Unluckily, Cournot cannot price discriminate since his customers all deal along with each other regularly. When Cournot maximizes his profit in that case: (1) he would sell 6,000 liters per period. (2) he would charge six Euros [€6 ] per liter. (3) his producer surplus would be 36,000 Euros. (4) buyers would enjoy a consumer surplus approximately valued at 18,000 Euros. (5) All of the above.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?