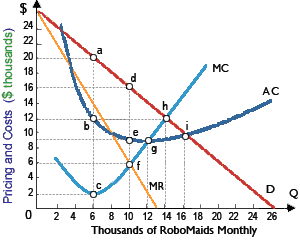

When Robomatic Corporation maximizes profit in its production of RoboMaids, its monthly total revenue will be roughly: (i) $100 million. (ii) $140 million. (iii) $160 million. (iv) $200 million. (v) $240 million.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?