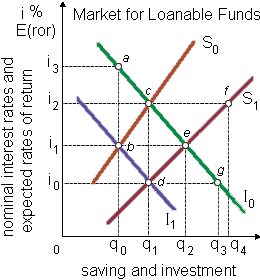

When this market is primarily in equilibrium at point c, any drop within interest rates caused through an increase in people’s willingness to save will cause as: (1) the rate of return schedule reflected into I0 to shift to the right. (2) the rate of return schedule reflected into I0 to shift to the left. (3) a movement down the rate of return schedule by point c to point e. (4) a movement up the rate of return schedule from point c to point a. (5) households to raise their saving.

Hello guys I want your advice. Please recommend some views for above Economics problems.