Question: This assignment in Economics, deals with macro-economics. An essay on Market imperfection associated with negative externalities. According to Economics, perfect markets would require an "invisible hand" to allocate all the resources to be at the right place and at the right time. But reality is far from true in most cases. This essay explains the externalities that usually make a market into an imperfect market.

- Introduction

- What is externality?

- Negative Externalities: Inefficient allocation of resources

- Regulating externality prone industries

- Taxes

- Command

- Marketable Pollution Permits

- Conclusion

- References

Market imperfection associated with negative externalities

A competitive market set up is said to be working "perfectly" when the "invisible hand" locates resources in such a manner that the resources are efficiently allocated and overall efficiency is achieved. Any kind of inefficiency in the allocation of resources leads to imperfection in the market. A market failure is typically a result of the inability of the markets to reach an efficient allocation of output which, more often than not, is also socially sub optimal. So while the profits of one or more parties involved in the production process might get maximized, the social welfare is compromised in the sense that it could be maximized by government interference. There are many reasons which might lead to imperfection in the market or its failure; externalities are one of them. An externality can be interpreted as the costs or benefits of a production process accruing to an economic agent who is not directly involved in the production process under consideration. It may not necessarily be harmful, as there are beneficial effects of externalities as well, as we study in more details below. The existence of externality, good or bad, indicates that the demand and supply mechanism of the market is not taking in to account all the costs and benefits which arise out of the production process. As a resultant of this, the market fails to produce optimal amount of output and hence, the social welfare is not maximized. In order to take care of this sub-optimal process, regulatory intervention may be desired at times, so as to direct the parties involved to incorporate the externality cost in account during the decision making process.

We study externalities in details below, its types, origination, mechanism and the possible solutions. However, our focus will remain on the negative externalities and its impact on the market. Rest of the paper is planned as following. In the first section we define externality and its types. In the second section we analyze the market mechanism underlying externalities and also an example in the Sri Lankan context. In the third section we look at the measures which can be taken in order to take care of externality. We finally conclude with the main findings and typical policy measures.

1. What Is Externality?

Under the capitalist mode of production, any production process which takes place is based upon the mechanics of cost and benefit analysis. The cost and benefits which the economic agents consider is private cost and private benefits; which are bore by the decision maker only. However, it may not contain the social costs and benefits- which accrue to the society as a whole. An externality happens when the decisions of the agents involved in the transaction affects those who are not a part of it. Externalities are of two types: (i) positive externalities and (ii) negative externalities. Positive externality happens when the actions of active agents affect the passive agents positively. An example is the presence of an educated person in a village who can spread awareness about sanitation. A negative externality, on the other hand, affects the passive agents adversely. For example, a non-smoker room partner may suffer health hazards due to another fellow smoker roommate. While the positive externalities tend to lower the social cost, negative externalities increase the social cost. These reasons typically lead to over or under production and hence, sub-optimal social welfare.

2. Negative Externalities: inefficient allocation of resources

In this section, we study how the presence of externality can lead to a sub-optimal provision of goods and services. As discussed above, the production process usually takes in toaccount only the private costs and benefits. This means that in the case of negative externality the social cost will be higher than the private cost. This is because of the fact that the people who are adversely affected, have to take care of the problems themselves and have to incur costs in order to deal with it. It can be physical, psychological or environmental cost. Therefore, the social costs are higher than the private costs.

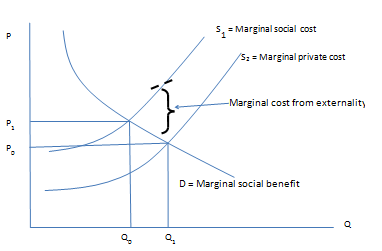

The graph below captures a market in the presence of negative externalities. The graph shows marginal private cost curve, labeled S2, and the marginal social cost curve, labeled S1, against the marginal social benefit curve, D. As we know now, the marginal social cost of production is higher than that of the marginal private cost of production. This means that the marginal social cost curve will always lie above the marginal private cost curve in the presence of negative externalities. Using the standard demandand supply analysis, we see that the private market equilibrium will happen at a point where price will be P0 and quantity will be Q0. However, with social costs incorporated, the optimal output will be Q1 and the corresponding price level will be P1. Therefore, in the presence of negative externalities, markets will produce an amount which will be above the socially optimal level while the prices will be lower than the optimal level.

So why does this happen? The competitive market optimal production happens where MR= MC, that is, marginal revenue equals the marginal cost. The same is happening here. The producer takes in to account his private marginal cost and private marginal revenue and decides the optimal level of production for profit maximization. However, the social cost is higher than the private cost and therefore, the social marginal cost is higher than the private marginal cost. So, if the social marginal cost is taken in to account, the optimal amount of output to be produced decreases due to high cost of production and correspondingly, the optimal price level also increases. This explains how and why the market usually tends to overproduce the goods when it is not regulated and when negative externalities are present.

A very relevant example to illustrate this mechanism is the use of pesticides for agriculture. Pesticides are meant to control different pests and insects which affect the harvest adversely. The pesticides are poisonous chemicals which kill the pests. However, the harmful effects of the pesticides can be many, as the soil and human beings are not totally insulated to the hazardous effects of pesticides. Excessive use of pesticides is known to affect the fertility of the land and also increase population which might affect the flora and fauna in the region. In addition to affecting the fertility of the land negatively after prolonged use, pesticides can also have poisonous effects on human beings, leading to death in several cases. The table below shows the ill-effects of pesticides on the men during the period of 1975-1996. The total deaths being caused due to pesticides infection have been following a secular upward trend during the period under consideration. What this in our discussion's context is that while the externality, caused by increasing use of pesticides over the period of time, and its costs, the human life impaired due to it, have been rising consistently; the production would also most likely be increasing.

A regulated market, which takes in to account the hazardous impact of the pesticides, will definitely produce lesser amount of output. There also might be certain clauses in terms of use and cap of utilization of the pesticides. If these measures are taken, the price of pesticides will automatically increase and curve over utilization. This will eventually lead to fall in the casualties due to pesticides and also conserve the fertility of the soil.

Deaths due to pesticides in Sri Lanka

|

Year

|

Total Pesticides Death

|

Total Pesticides admissions

|

Deaths per 100,000

population

|

|

1975

|

938

|

14653

|

-

|

|

1976

|

964

|

13778

|

-

|

|

1977

|

938

|

15591

|

-

|

|

1978

|

1029

|

15504

|

-

|

|

1979

|

1045

|

11372

|

-

|

|

1980

|

1112

|

11811

|

-

|

|

1981

|

1205

|

12308

|

-

|

|

1982

|

1376

|

15480

|

-

|

|

1983

|

1521

|

16649

|

-

|

|

1984

|

1459

|

16085

|

-

|

|

1985

|

1439

|

14423

|

-

|

|

1986

|

1452

|

14413

|

-

|

|

1987

|

1435

|

12841

|

8.8

|

|

1988

|

1524

|

12997

|

9.2

|

|

1989

|

1296

|

12763

|

7.7

|

|

1990

|

1275

|

10783

|

8.8

|

|

1991

|

1667

|

13837

|

11.3

|

|

1992

|

1698

|

15636

|

-

|

|

1993

|

1682

|

16692

|

9.5

|

|

1994

|

1421

|

14979

|

8.1

|

|

1995

|

1581

|

15740

|

9.5

|

|

1996

|

1850

|

21129

|

-

|

3. Regulating externality prone industries

As mentioned in brief earlier, the presence of negative externality may necessitate government or other kind of regulatory intervention in the free market in order to ensure socially optimal level of production. This on one hand ensures that the damages due to externalities are controlled, while on the other hand, it also helps in looking for alternative and less cost alternatives to production, as the cost increases in the presence of regulations. Below we discuss few commonly used regulatory methods to control for the negative externalities' effect to the environment:

Taxes:

One of the simplest ways to control the excessive production in case of negative externalities is to internalize the social costs in the decision making process. This follows a very simple and uncomplicated way. The idea is to charge the amount of tax from a polluter equivalent to amount which is being damaged due to production. In other words, it is basically about recovering the damages by the producers. This leads to internalization of costs and hence, when the producer takes his production decisions, the cost of externality will be taken in to account and there will not be over production.

Command:

Another way of controlling the externality induced damages is Command. Under this system, the government just commands the polluting company/firm/factory to eitherstop operations or to limit the pollutant emissions up to a certain optimal level. This ensures that there is no over production and hence, extra pollution and damage to the environment.

Marketable Pollution Permits:

In this system, the government decides beforehand the permissible amount of pollution in terms of emissions and other forms. Now, the firms bid in order to buy the limits for their own production needs. What happens after this is that those firms which cannot utilize their full limits can sell the rights to other firms. Similarly, the firms who have crossed their limits can look for sellers to buy extra limits. This, again, helps to control the emissions and minimizes the damages and also provides the firms with an incentive to innovate so that they do have to buy lesser and lesser amount of permit.

4. Conclusion

Externalities are said to be present in the market when the action of active decision makers affect the passive economic agent, who is not involved in the transaction. Externalities tend to affect the social cost of production- it might be higher or lower. In case of positive externalities the costs are lower while in case of negative externalities they are higher. However, as this cost differential is mainly social in nature and does not feature in the private costs calculation, the producers tend to over produce the quantity in the presence of negative externalities. Further, the prices are also lower which induces higher consumption and more ill-effects of externalities. The marginal returns are the same for the firms, however, the marginal costs will increase in the cost of negative externality is internalized. This will ensure that the quantity of output produced is in line with the social benefits optimization and also, as an aftermath, lower the damage being done due to presence of externalities. As the situation demands, government intervention becomes important and necessary under these circumstances. The government can regulate the industry by imposing taxes, commanding the firms to limit their emission limits and also through marketable pollution permits. These measures should be well programmed in order to limit the damages caused by negative externalities and also take care of the desired production level. These regulations, in addition to limiting pollution and containing damages to environment, may also trigger innovation in the market as the firms try to learn and find new ways in order to control their costs of production and the additional costs incurred due to the externality incorporation.