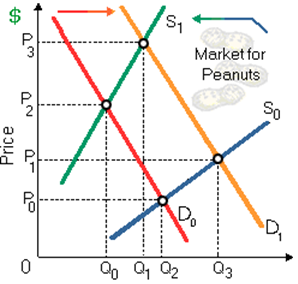

This market for peanuts will adjust to a new equilibrium at price: (1) P0 and quantity Q0. (2) P1 and quantity Q0. (3) P2 and quantity Q2. (4) P3 and quantity Q1. (5) P1 and quantity Q1.

How can I solve my economics problem? Please suggest me the correct answer.