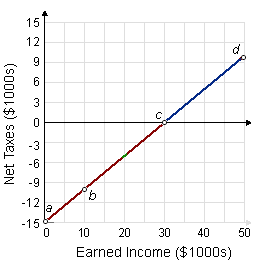

The marginal tax rate upon earned income under negative income tax system demonstrated in this figure is: (1) 15 percent. (2) 20 percent. (3) 25 percent. (4) 33.3 percent. (5) 50 percent.

Hello guys I want your advice. Please recommend some views for above Economics problems.